Blog

New Feature Alert: Daily Deal Analysis. Fully Automated!

Deal Alerts automate your investment search. Instead of manually analyzing listings every day, you define your area, filters, and minimum cash-on-cash return — and REI Lense runs daily analysis for you. When a property meets your return threshold, you get notified. No noise. No endless browsing. Just deals that hit your numbers.

5 min read

February 27th, 2026

Mortgage rates fall to 5.98%—why many buyers are still priced out

Mortgage rates hit 5.98% on Feb. 26, 2026, but high prices, tight entry-level supply, and low turnover mean affordability remains strained.

6 min read

February 27th, 2026

Why the Frozen Housing Market Is Dragging on Home Depot, Remodel Demand, and 2026 Turnover

U.S. housing turnover remains near multi-decade lows, rippling into big-ticket remodel demand and home-improvement retail even as mortgage rates ease.

7 min read

February 26th, 2026

Home prices are barely rising — but inflation and rates keep housing affordability strained

Late-2025 data show home-price growth slowing and turning negative in real terms, while affordability metrics remain challenging across much of the U.S.

7 min read

February 26th, 2026

Investor limits on single-family homes: how purchase caps and tax changes could ripple through local markets

Proposals to limit large investors in single-family homes could affect prices, rents, and inventory—mostly in metros with concentrated SFR portfolios and depending on thresholds and exemptions.

7 min read

February 25th, 2026

How U.S. communities are responding to housing affordability: education, senior housing, and zoning bottlenecks

Local affordability responses range from homebuyer education to senior housing pipelines and zoning/approval debates as rate-sensitive demand shapes early 2026.

6 min read

February 23rd, 2026

New Home Sales Stayed Elevated in Late 2025 — But the 2026 Construction Pipeline Looks Fragile

New-home sales ended 2025 near a 745,000 annual pace, but weaker single-family permits and starts point to a fragile 2026 supply pipeline.

7 min read

February 23rd, 2026

A proposed 100-home cutoff for institutional buyers: what it could mean for single-family inventory

Draft language would restrict some large institutional investors from buying more single-family homes at a reported 100-home threshold, with exemptions like build-to-rent shaping the impact.

6 min read

February 21st, 2026

What a 100+ home investor buying cap could mean for single-family prices, rentals, and supply

Draft language would limit single-family home purchases by large investors (100+ homes), with carve-outs for build-to-rent and major rental rehabs. Here’s what could change.

7 min read

February 20th, 2026

States advance pro-building policies to boost housing supply and lower per-unit costs

States and localities are advancing supply-side housing policies—ADUs, duplex zoning, parking caps, and targeted funding—to expand attainable housing.

6 min read

February 19th, 2026

Investors’ share of U.S. home buying remains elevated — and local concentration is the affordability flashpoint

New 2026 data points show investor activity remains elevated in U.S. housing, with the biggest affordability impact where investors concentrate in entry-level homes.

7 min read

February 18th, 2026

Investor Buying Stays Elevated: What 2025 Data Says About 2026 Homebuyer Competition

Investor participation in single-family homes stayed elevated through late 2025. Here’s what the latest data shows nationally and in markets like Miami and California’s Central Valley.

6 min read

February 18th, 2026

Assumable Mortgages in 2026: How Buyers Can Get Sub-3% Rates—and the Tradeoffs

Assumable FHA and VA mortgages can let buyers keep ultra-low pandemic-era rates, but equity gaps, qualification rules, and slow processing limit who can use them.

6 min read

February 16th, 2026

Investors Held About 30% of U.S. Home Purchases in 2025—What That Means for Buyers

Cotality data summarized by HousingWire show investors held about 30% of U.S. single-family home purchases through 2025, with big differences by metro.

6 min read

February 16th, 2026

Existing-Home Sales Slumped in January 2026 Even as Affordability Improved: What the Data Says

January 2026 existing-home sales fell sharply even as affordability improved. Here’s what NAR’s data says about rates, inventory, and demand.

6 min read

February 16th, 2026

Existing-Home Sales Drop 8.4% in January, Even as Affordability Improves: What It Means for Spring 2026

Existing-home sales fell 8.4% in January, but affordability improved to its best level since March 2022 as rates eased and income growth outpaced prices.

6 min read

February 16th, 2026

Why investor-ban headlines may still lead to more renting (built-to-rent carve-outs explained)

Investor restrictions may curb competition for existing homes, but built-to-rent carve-outs can steer capital toward new rental neighborhoods instead of starter homes.

7 min read

February 16th, 2026

What the Housing for the 21st Century Act could change for homebuilding costs in 2026

The House passed the Housing for the 21st Century Act as lawmakers focus on lowering build costs, streamlining reviews, and offsetting impact fees to boost supply.

7 min read

February 11th, 2026

What the Housing for the 21st Century Act Would Change for Housing Supply (Permits, Zoning, Finance)

The House advanced the Housing for the 21st Century Act, a supply-focused package targeting permitting delays, program updates, and financing rules that can unlock more homes.

6 min read

February 10th, 2026

Is the Housing Affordability Crisis Really a Supply Shortage? New Research Points to Demand and Income

New SF Fed research suggests home prices track income-driven demand more than unit counts, even as inventory improves and rates hover near 6%.

7 min read

February 8th, 2026

States and cities move from housing targets to tools: faster permits, missing middle, and gap financing

States and cities are tightening housing affordability tools: faster approvals, missing-middle reforms, gap financing, and new investor guardrails in early 2026.

6 min read

February 6th, 2026

Entry-Level “Trump Homes,” Rent-to-Own, and Investor Caps: What They Mean for U.S. Housing Supply

Builders are pitching entry-level supply and rent-to-own concepts as cities test investor caps and factory-built homes promise faster delivery.

7 min read

February 6th, 2026

What “Trump Homes” Means for Affordability: Rent-to-Own Claims, Builder Pushback, and the Rate Risk

A rent-to-own “Trump Homes” concept is in the news, but builders say no coordinated national program is underway. Here’s what it could mean for prices, rates, and supply.

6 min read

February 4th, 2026

Can Mortgage-Rate Relief Lower Payments Without Driving Home Prices Higher?

A proposed $200B mortgage-bond purchase aims to lower mortgage rates, but analysts warn cheaper financing can lift home prices when inventory is tight.

6 min read

February 4th, 2026

Buyer Power Slowly Returns as Regional Price Growth Cools

Regional cooling is improving buyer leverage: more listings, more price cuts, and softer conditions in parts of the West and Southwest Florida, while some ZIP codes still rise.

6 min read

February 2nd, 2026

Local Housing Policy Experiments: What’s Working to Add Supply (and What May Raise Prices)

Cities and states are testing smaller-lot zoning, property-tax relief, adaptive reuse, tiny homes, and sweat-equity programs to improve housing affordability.

6 min read

February 1st, 2026

Why ‘Keeping Home Prices High’ Conflicts With Affordability—and What Actually Moves Payments

Home values and affordability often pull in opposite directions. With 30-year rates near 6%, 2026 relief may come from slower price growth and easing borrowing costs.

7 min read

January 31st, 2026

Why “Keep Prices High, Cut Rates” Keeps Housing Affordability Stuck

Keeping home prices high while relying on lower mortgage rates may protect owner equity but leaves first-time buyer affordability constrained without more supply.

6 min read

January 31st, 2026

Luxury housing stays strong while the rest of the market cools: what the split means in 2026

Mainstream buyers face affordability strain, but luxury demand is more resilient. Here’s what the split market means for pricing and new construction.

6 min read

January 29th, 2026

Record Homebuyer Deal Cancellations, but Prices Still Rise: What the Data Say Heading Into 2026

Redfin data show December home-purchase cancellations surged, while Case-Shiller and FHFA still report modest home price gains heading into 2026.

6 min read

January 28th, 2026

U.S. Home Prices Pick Up Again—But Regional Divergence Is Now the Main Story

FHFA and Case-Shiller show November home prices rising again, but gains are concentrating in the Midwest and Northeast as parts of the South and West cool.

6 min read

January 28th, 2026

Mortgage-rate stimulus vs. supply fixes: what the newest housing-cost proposals could mean

New housing-cost proposals split between faster mortgage-payment relief and slower supply expansion. Here’s what each could mean for affordability and inventory.

7 min read

January 26th, 2026

Investor scrutiny on single-family home buying: why build-to-rent may be the near-term winner

A new executive order increases scrutiny of bulk single-family home buying, potentially shifting competition in starter-home markets and supporting build-to-rent development.

6 min read

January 26th, 2026

Home Prices Are Flat in Some Metros—So Why Does Affordability Still Feel Worse?

Prices may be flat in some metros, but high rates and an entry-level supply gap keep U.S. homeownership affordability strained.

6 min read

January 26th, 2026

Institutional Landlords Face Growing Scrutiny in Single-Family Rentals—What the Data Actually Shows

Institutional landlords are under renewed scrutiny. Research finds mixed impacts, with ownership concentrated in certain metros and neighborhoods.

7 min read

January 21st, 2026

Rent caps, disclosure mandates, and enforcement: the new front line in U.S. rental housing

Rent caps and tenant disclosure rules are tightening in key U.S. markets. Here’s what changes in LA, NYC, and Washington mean for rents and operations.

7 min read

January 20th, 2026

Algorithmic Rent-Setting Is Under Pressure: What New Settlements and State Bans Mean

Settlements and new state rules are tightening how rent-setting algorithms can use nonpublic competitor data and shape pricing in U.S. apartment markets.

6 min read

January 19th, 2026

Rent rules tighten nationwide: caps, fee limits, and enforcement raise landlord compliance stakes

U.S. cities and states are tightening rent rules with updated caps, fee limits, and more enforcement, increasing compliance demands for landlords.

6 min read

January 17th, 2026

States and cities crack down on illegal rent hikes, rent caps, and fee workarounds

States and cities are enforcing rent caps and fee rules with refunds, settlements, and tighter rent-stabilization limits that raise compliance stakes.

7 min read

January 16th, 2026

Small and ‘Accidental’ Landlords Are Reshaping U.S. Rental Supply

Small landlords still own a large share of U.S. rentals, especially 1–4 unit properties. Here’s how their costs and decisions affect rents, quality, and supply.

6 min read

January 14th, 2026

Landlords Face a New Squeeze: Cooling Rent Growth Meets Rising Operating and Compliance Costs

Rent growth is cooling nationally, but operating costs and new compliance rules are rising—squeezing landlord margins even as tenants remain cost-burdened.

7 min read

January 12th, 2026

Algorithmic Rent-Setting Crackdown: What New Bans and Settlements Mean for U.S. Apartment Pricing

Bans and settlements are limiting rent-setting algorithms that use competitors’ nonpublic data, reshaping U.S. apartment pricing, compliance, and documentation.

6 min read

January 11th, 2026

Cooling and Appliance Requirements Are Redefining Rental Habitability Standards

California and Los Angeles County are expanding rental habitability rules to include core appliances and indoor cooling standards, changing landlord compliance obligations.

6 min read

January 10th, 2026

Cities escalate enforcement against big landlords: hearings, fines, and rent-setting scrutiny

Cities and states are escalating enforcement against large landlords—through hearings, fines, and settlements focused on rent practices and housing conditions.

6 min read

January 8th, 2026

Rent enforcement is escalating: refunds, penalties, and new limits on algorithmic rent-setting

Enforcement actions are driving rent refunds, penalties, and new limits on algorithmic rent-setting tools tied to alleged coordinated pricing.

7 min read

January 7th, 2026

NYC’s ‘Rental Ripoff’ Hearings: What They Are, What They Can Change, and What to Watch

NYC is launching “Rental Ripoff” hearings in all five boroughs to collect tenant testimony on fees and conditions, then publish a report aimed at guiding enforcement.

7 min read

January 7th, 2026

Rental Fees Are the New Front Line: How Local Rules Are Changing the True Cost of Renting

Cities and states are targeting add-on rental charges and rent hikes, pushing clearer all-in pricing and changing how owners structure leases.

6 min read

January 5th, 2026

How New Rent Control And Rent Cap Reforms Are Reshaping Local Rental Markets

Local rent caps and rent control updates in cities like Los Angeles and states like Washington are reshaping how U.S. landlords set rents and how stable tenants’ costs can be.

8 min read

January 4th, 2026

Rents Are Outpacing Inflation While Landlords Say They’re Squeezed: What’s Really Going On?

Rents are rising faster than inflation nationwide even as many landlords report higher costs, highlighting mounting affordability and cash-flow strains in pricey U.S. cities.

7 min read

January 4th, 2026

How Regulators Are Cracking Down on Rent Price Fixing Beyond Algorithms

Federal and state regulators are expanding rent price-fixing enforcement, combining algorithm cases with broader crackdowns on landlord data-sharing and coordination.

8 min read

January 2nd, 2026

How New City Rules on Short Term Rentals Could Reshape Local Housing Markets

Many U.S. cities are tightening short term rental rules with primary-residence limits, caps on investor units, and tougher enforcement, reshaping local housing markets.

8 min read

January 2nd, 2026

How Rental Inspection Mandates and Registries Are Reshaping U.S. Landlord–Tenant Rules

Cities nationwide are expanding rental inspections, fees, and registries to tackle unsafe housing, while landlords raise legal and cost concerns.

8 min read

December 31st, 2025

How New Cooling Mandates and Habitability Rules Are Rewriting Rental Landlord Obligations

Local governments are tightening cooling, appliance, and inspection rules, raising landlord costs while aiming for safer, healthier rental housing.

9 min read

December 31st, 2025

Inside DC’s RENTAL Act: How a sweeping eviction and rent-debt overhaul could reshape the rental market

DC’s proposed RENTAL Act would extend eviction timelines, curb late fees and add paperwork for landlords, raising questions about rental supply and tenant stability.

8 min read

December 29th, 2025

How NYC’s New Broker-Fee Rules Could Reshape Rents, Leasing, and Affordability

NYC’s new broker-fee rules shift commissions from renters to landlords, cutting move-in costs but raising questions about how much of that expense will flow into rents.

7 min read

December 28th, 2025

Local Rent Control Is Entering a New Phase: Tighter Caps, Tougher Enforcement, and Bans on Rent Algorithms

States and cities are tightening rent caps, ramping up enforcement, and banning some rent algorithms, reshaping the risk calculus for landlords, investors, and renters.

8 min read

December 27th, 2025

How LA’s New 82°F Cooling Mandates Could Rewrite Rental Housing Standards

LA city and county are moving to cap indoor rental temperatures at 82°F, making cooling a habitability standard that could reshape landlord costs and tenant protections.

8 min read

December 26th, 2025

Rents Keep Climbing While Landlords Say They’re Squeezed: What’s Really Happening in the U.S. Rental Market?

Rents are still rising faster than inflation, yet many U.S. landlords say higher costs and tighter rules are shrinking margins. Here’s how that tension plays out.

9 min read

December 25th, 2025

How New Rules On Deposits, Fees, and Evictions Are Rebalancing U.S. Rentals

Cities and states are rewriting rules on deposits, rental fees, and nonpayment evictions, reshaping who carries risk and upfront costs in U.S. rentals.

10 min read

December 25th, 2025

Regulators Escalate Crackdown on Alleged Landlord Rent Collusion, With and Without Algorithms

Recent cases in DC, NC, NJ and CA show regulators cracking down on landlords accused of coordinating rents through shared data and algorithmic pricing tools.

7 min read

December 23rd, 2025

How New Rent Caps, Fee Limits, and Pricing Rules Are Reshaping Life for Small Landlords

From rent caps to fee limits and broker-fee shifts, new rules are squeezing small landlords’ margins and changing how they screen, invest, and decide whether to stay in the market.

10 min read

December 22nd, 2025

How Crackdowns on Rent Algorithms Are Reshaping Multifamily Pricing for Big Landlords

Federal and state actions against RealPage-style rent algorithms and major landlords like Greystar and Cortland are reshaping how multifamily rents can be set.

7 min read

December 21st, 2025

How Local Rent Relief and Disaster Programs Are Propping Up Small Landlords and Tenants

Local rent relief and disaster recovery programs are tying landlord support to tenant stability, from Renew NC’s Helene repairs to L.A. County’s fire-related rent grants.

8 min read

December 20th, 2025

How New Health and Safety Standards Are Raising Operating Costs for Landlords

New health and safety standards for rentals – from appliances to cooling and lead safety – are raising operating costs for landlords and squeezing bare-bones units.

8 min read

December 20th, 2025

How Local Landlord Registries and Inspection Mandates Are Reshaping U.S. Rentals

Cities from Jackson to Pasadena are rolling out landlord registries, per-unit fees, and proactive rental inspections that are raising compliance stakes for rental owners.

8 min read

December 20th, 2025

How Local Incentives Are Pulling Landlords Into Rental Code Compliance

Cities are testing grants, bonuses, and online tools to bring landlords into rental code compliance without shrinking tight housing supply.

7 min read

December 16th, 2025

Why Landlords Feel Squeezed Even as U.S. Rents Keep Climbing

Rents are rising faster than inflation, yet many U.S. landlords say higher expenses, concessions and payment risk are squeezing margins.

8 min read

December 15th, 2025

State Attorneys General Are Redrawing the Lines on Rent Hikes and Algorithmic Pricing

State attorneys general in NC, OR, WA and DC are forcing big landlords to refund illegal rent hikes, obey rent caps, and curb algorithmic rent-setting.

8 min read

December 14th, 2025

How Accidental Landlords and Wall Street Investors Are Rewriting the U.S. Rental Market

Locked-in homeowners are becoming accidental landlords, adding single-family rentals and new competition for big investors while rent growth still outpaces inflation.

7 min read

December 12th, 2025

From Heat Waves To Habitability: How Cities Are Tightening Cooling Rules And Rental Inspections

As extreme heat and safety concerns grow, cities like Los Angeles, Detroit and Parkersburg are tightening rental cooling, inspection and habitability rules.

7 min read

December 11th, 2025

How New Local Rental Rules Are Reshaping the Landlord–Tenant Balance Across U.S. Cities

Cities and states are tightening rental rules on inspections, rent caps, fees, and cooling, raising compliance costs and forcing landlords to rethink where and how they invest.

9 min read

December 11th, 2025

How New Tenant Protection Laws Are Reshaping U.S. Rental Housing

Cities and states are expanding tenant protections – from rent caps and cooling mandates to inspections and fee limits – reshaping risks for renters and landlords.

8 min read

December 10th, 2025

Investors Now Buy Nearly One in Three U.S. Homes: What It Means for Prices, Renters, and First-Time Buyers

Investors now buy close to 1 in 3 U.S. single-family homes, reshaping competition for buyers as domestic and international capital targets rental demand.

7 min read

December 9th, 2025

When Rent Eats Everything: How Extreme Renter Cost Burdens Are Undermining US Household Finances

Harvard's latest research shows 65% of working-age U.S. renters can't cover basic necessities after paying rent, reshaping budgets, savings, and housing prospects.

7 min read

December 7th, 2025

How Short-Term Rental Management Firms Are Reshaping Hosting Across U.S. Markets

Tech-enabled short-term rental management firms are expanding across U.S. markets, professionalizing hosting and changing how investors and small owners participate.

5 min read

December 5th, 2025

Greystar’s $24 Million Junk-Fee Settlement: What It Means for U.S. Renters and Landlords

A $24 million federal settlement with Greystar over alleged rental junk fees could force clearer, all-in rent pricing across large U.S. multifamily landlords.

7 min read

December 4th, 2025

2026 Housing Outlook: Why At Least 22 U.S. Cities May See Home Prices Fall Even as the Nation Edges Higher

New 2026 housing forecasts point to modest national price gains but nominal declines in at least 22 U.S. metros, reflecting a localized reset driven by affordability and inventory.

7 min read

December 4th, 2025

How Wall Street’s Push Into Single-Family Rentals Is Reshaping Long-Term Renting in America

Large investors are expanding single-family rentals and build-to-rent communities as long-term rentership rises and affordability keeps more households renting.

8 min read

December 2nd, 2025

Long-Term Renting Is Reshaping U.S. Housing: Affordability, Investors and the New Normal

High housing costs and inflation are adding millions of long-term renters, boosting single-family rentals and reshaping how investors and retailers navigate U.S. housing.

7 min read

December 1st, 2025

2026 U.S. Housing Market Forecast: Stable Mortgage Rates, Slower Price Growth and Stubborn Costs

Housing forecasts for 2026 point to mid‑6% mortgage rates, slower price growth and a rebound in sales—but rising insurance, taxes and other costs keep affordability tight.

7 min read

November 30th, 2025

Oops, We Slept Through Black Friday… Enjoy 50% Off Anyway!

Your 50% discount is live for a limited time. New users can save big on REI Lense this weekend — offer ends Monday, Dec 1st 2025 at 11:59 PM. Use promo code "INVEST2025" at checkout to apply your discount

1 min

November 29th, 2025

Why All-Cash Buyers Now Dominate New York City Home Sales — And What It Means for Affordability

More than 60% of NYC home sales in early 2025 were all-cash, far above the national share, reshaping affordability and competition for mortgage-dependent buyers.

6 min read

November 29th, 2025

Santa Fe’s New Minimum Wage Formula: Linking Paychecks to Local Rents

Santa Fe is the first U.S. city to link its minimum wage to local rents, using a blended inflation–rent formula to tackle housing affordability.

7 min read

November 28th, 2025

VA Home Loans: The Underused Zero‑Down Benefit That Helps Veterans Buy Years Sooner

Realtor.com’s new analysis shows VA home loans can help qualified veterans buy homes more than four years sooner on average by removing the down payment hurdle.

7 min read

November 28th, 2025

How Fed Rate Cuts and Cheaper Mortgage Costs Are Slowly Thawing the U.S. Housing Market

Recent and expected rate cuts are lowering mortgage and home equity costs, nudging buyers, refinancers, and renovators toward a slow thaw in the U.S. housing market.

7 min read

November 28th, 2025

50-Year Mortgages in the U.S.: Lower Payments Today, Bigger Risks Tomorrow

A look at proposed 50-year mortgages in the U.S., how much they really cut payments, and why they may increase total interest and risk without fixing housing affordability.

7 min read

November 28th, 2025

How Creative Financing and Hybrid Short‑Term Rental Loans Are Changing the Game for Small US Investors

Hybrid short-term rental loans and smarter rate strategies are helping small U.S. real estate investors qualify, buy rentals, and manage cash flow despite higher rates.

7 min read

November 28th, 2025

Refinance Wave Builds as Mortgage Rates Fall: What It Means for Homeowners and the Housing Market

As US mortgage rates fall into the low‑6% range, refinance demand is surging while housing turnover and home sales remain historically subdued.

7 min read

November 23rd, 2025

Portable Mortgages in the U.S.: How Taking Your Rate With You Could Reshape Housing

The U.S. is studying portable mortgages that let borrowers take their low rates to a new home, aiming to ease the housing lock-in effect and reshape mobility.

7 min read

November 22nd, 2025

How Corporate and Institutional Investors Are Reshaping Local Homeownership in U.S. Markets

Investor buyers are capturing a growing share of U.S. homes, from Philly rowhouses to Orlando multifamily deals, reshaping rental supply and access to homeownership.

7 min read

November 21st, 2025

How Soaring Home Insurance Costs Are Quietly Reshaping the U.S. Housing Market

Rising homeowners insurance premiums are taking a record share of U.S. housing payments, reshaping affordability, demand, and real estate underwriting.

8 min read

November 21st, 2025

The Crackdown on Rent-Setting Software: How New Rules Could Reshape U.S. Rents

A Greystar settlement and Portland’s proposed ban on algorithmic rent-setting signal a new era of scrutiny for how U.S. landlords use software to price rentals.

7 min read

November 20th, 2025

How Older Repeat Buyers Are Quietly Reshaping U.S. Homeownership

Older repeat buyers and cash-rich boomers now dominate U.S. home purchases, pushing the typical first-time buyer age to 40 and widening the homeownership gap.

8 min read

November 18th, 2025

The Real Cost of Owning a Home in 2025: Hidden Expenses Now Near $16,000 a Year

Zillow and Thumbtack say hidden homeownership costs now average $15,979 a year as mortgage rates hover near 6.24%, tightening U.S. housing budgets.

6 min read

November 17th, 2025

Mortgage Lock‑In: Why Homeowners Aren’t Moving—and How It’s Freezing Supply

Fed and FHFA research show mortgage rate lock‑in stalled moves and sales. With the 30‑year fixed near 6.24%, listings stay tight even as applications rise.

6 min read

November 17th, 2025

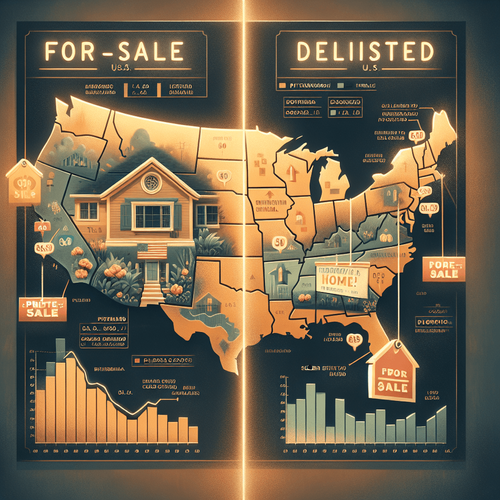

Affordability Squeeze Is Reshaping U.S. Housing: Price Cuts, Delistings, and a Shift to Cheaper Metros

Affordability is steering U.S. housing: price cuts and delistings are up as buyers shift to cheaper metros like Pittsburgh and parts of Florida.

6 min read

November 16th, 2025

50-Year Mortgages in the U.S.: What They’d Really Do to Payments, Prices, and Risk

A 50-year mortgage would trim monthly payments but raise total interest, slow equity, and faces big QM and GSE hurdles. Here’s what U.S. buyers should know.

6 min read

November 15th, 2025

Are Investors Really Buying One-Third of U.S. Homes? The 2025 Housing Investor Boom, Explained

Investor share of home purchases is elevated in 2025. Builders court small landlords, fractional platforms add trading, and rents look flat-to-stabilizing.

6 min read

November 14th, 2025

Low-6% Mortgage Rates Bring Refi Revival and Builder Buydowns—While 50-Year Loans Loom as a Debate

U.S. mortgage rates hover near 6%. Refinances are back, builders are buying down rates, and 50-year loans are being debated. What buyers and owners should know now.

5 min read

November 13th, 2025

REI Lense for iOS — See Investment Metrics Inside Your Favorite Real-Estate Apps: Zillow, Redfin, Realtor, and Maps!

The brand-new REI Lense app brings instant investor insights (Rent, Cashflow, Cash on Cash, Cap Rate) directly into other mobile apps: Zillow, Redfin, Realtor, Google Maps, and Apple Maps!

2 min

October 1st, 2025